Welcome to MASEconomics, your trusted source for insights into the complex world of economics. Central Bank Digital Currencies (CBDCs) are emerging as a powerful force with the potential to reshape how nations transact and interact with their currency.

As countries contemplate the adoption of CBDCs or find themselves at various stages of CBDC development, we offer this comprehensive guide, drawing insights from the International Monetary Fund’s (IMF) Fintech Notes, to illuminate the path and phases central banks traverse on their CBDC journey.

let’s begin by understanding the foundational 5P methodology.

The 5P Methodology

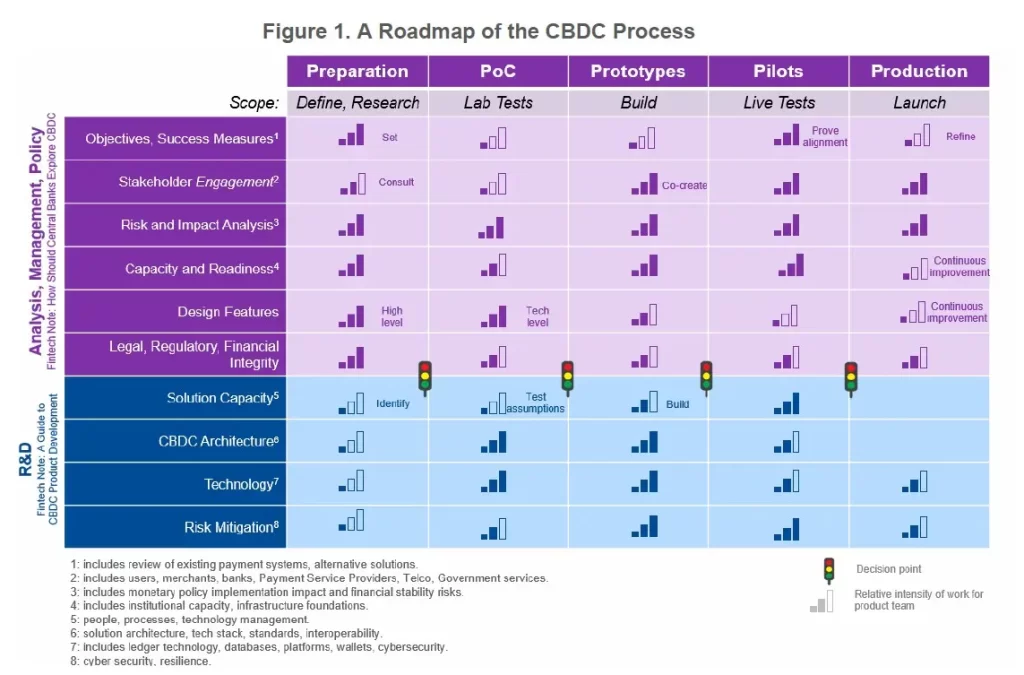

The IMF provides a structured approach to CBDC development called the 5P Methodology. This methodology consists of five phases, each serving a unique purpose:

- Preparation Phase: This is where it all begins. During this phase, central banks lay the groundwork for CBDC development. They identify critical questions related to CBDC, assess potential risks, and establish clear policy objectives. It’s about setting the stage for informed decision-making.

- Proof-of-Concept Phase: Once the groundwork is laid, it’s time to validate or invalidate assumptions about CBDC. This phase involves low-cost activities to test policy objectives, user motivations, and technology options.

- Prototypes Phase: With insights from the Proof-of-Concept phase, central banks develop a working CBDC prototype. They select partners, build capacity, and conduct testing in low-risk settings to refine their ideas.

- Pilots Phase: Real-world testing is essential. During the pilot phase, CBDCs are tested in live environments, involving all stakeholders. This phase assesses scalability, resilience, user experience, adoption, and various scenarios.

- Production Phase: This is the culmination of the CBDC journey, marked by the official launch and ongoing management of CBDCs. It’s where theory becomes practice, and central banks must continuously evaluate, iterate, and improve based on real-world experience.

Go/No Go Checkpoints

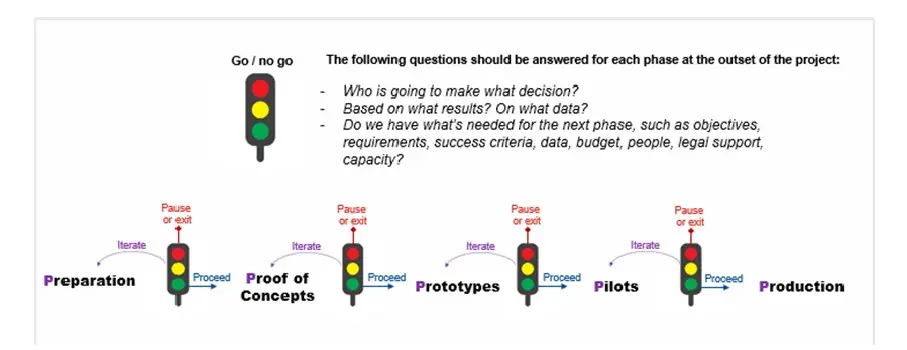

A crucial aspect of the 5P Methodology is establishing “go/no go” decision points at the intersection of each phase. These decision points determine whether to iterate within the same phase, proceed to the next phase, move forward with some elements while staying in the same phase for other unresolved questions, or pause or stop the project. These decisions involve central bank authorities, team members, and stakeholders and ensure alignment on progress, lessons learned, and next steps.

With a grasp of the 5P methodology, let’s enter the next Phase, where central banks lay the groundwork for CBDC development.

Exploring the Idea: The Consideration Phase

For countries at the outset of their CBDC journey, the Consideration Phase is where it all begins. During this phase, central banks engage in a thoughtful evaluation of the advantages and disadvantages of introducing a CBDC. This reflective process entails the following:

- Defining Clear Policy Objectives: The journey commences with a clear vision of what the CBDC aims to achieve. Policymakers define precise policy objectives, which serve as the guiding North Star throughout the CBDC development.

- Identifying Potential Risks: A thorough risk assessment is essential. Central banks must meticulously identify potential pitfalls and vulnerabilities to mitigate them effectively.

- Stakeholder Analysis: Active stakeholder engagement is pivotal. Seeking input from diverse stakeholders, including the general public, is invaluable. These consultations offer insights into the specific needs and concerns of the community.

Planning and Preparation: The Blueprint Phase

With a well-defined vision in place, countries transition to the Blueprint Phase. Here, the focus shifts to the technical and regulatory aspects of CBDC implementation. Key actions include:

- Technical Requirements: Outlining the technical specifications and requirements for CBDC implementation is crucial. This phase serves as the blueprint for the CBDC’s technological infrastructure.

- Legal and Regulatory Frameworks: Adapting legal and regulatory frameworks to accommodate this digital innovation is paramount. Collaborations with experts and stakeholders help shape a detailed blueprint for the CBDC’s future.

Building the Foundation: The Infrastructure Phase

The transition to the Infrastructure Phase marks a pivotal moment in the CBDC development journey. During this phase, the foundational elements necessary to support CBDCs are established:

Setting Rigorous Standards

Countries understand that CBDC’s success hinges on a solid foundation. Therefore, the Infrastructure Phase commences with the establishment of rigorous standards, including:

- Security: Central banks work tirelessly to ensure the CBDC infrastructure’s resilience against potential threats. This involves implementing advanced encryption and authentication protocols to safeguard the CBDC and user data.

- Interoperability: Ensuring CBDCs can seamlessly integrate with existing payment networks and financial infrastructure is vital. This enables smooth value exchange between CBDCs and other forms of currency.

- Accessibility: Making CBDCs accessible to all segments of society is a core principle. This involves addressing issues related to the digital divide and financial inclusion.

Collaboration with Technology Partners and Third-Party Providers

To achieve ambitious goals, countries actively engage in collaborations with technology partners and third-party providers, encompassing:

- Technology Expertise: Seeking technology partners renowned for their expertise in building secure digital financial systems is crucial. They play a pivotal role in architecting the technical infrastructure.

- Regulatory Compliance: Third-party providers navigate complex regulatory landscapes and assist in ensuring CBDCs adhere to relevant financial and data protection regulations.

- Pilot Programs: Collaborative efforts may involve pilot programs to test and refine the CBDC infrastructure. These trials provide invaluable insights and data.

- Capacity Building: Equipping staff with the necessary skills and knowledge to oversee and manage CBDC infrastructure is essential.

The Infrastructure Phase is not merely about laying foundations. It’s about building flexibility into the infrastructure to adapt and grow alongside technological advancements. As countries solidify the core infrastructure for CBDCs, they must remain committed to:

- Fostering financial stability.

- Enhancing payment systems.

- Promoting financial inclusion.

This ongoing pursuit of excellence ensures that CBDCs are not just a digital innovation but a lasting force for positive change in finance.

Experimentation and Development: The Innovation Phase

As countries progress on their CBDC journey, they reach the Innovation Phase—a stage characterized by rigorous experimentation and the development of CBDC prototypes. This phase plays a pivotal role in shaping the future of digital currency.

Preparation Paves the Way

Before diving into experimentation, comprehensive preparation is essential. This phase establishes vital requirements and guidelines. Notably, the dynamic nature of CBDC development allows for the revision of conclusions as the process unfolds.

Specification of Key Success Measures

The Innovation Phase hinges on defining success metrics aligned with policy objectives. These Key Performance Indicators (KPIs) encompass various dimensions, such as adoption rates, transaction volume, and geographic reach. These metrics are derived directly from policy goals and risk mitigation strategies.

Testing Multiple Aspects: Proof of Concepts (PoCs)

Countries embark on empirical investigations in the Innovation Phase, known as Proof of Concepts (PoCs). These simulations address specific questions about CBDC functionality and policy objectives. PoCs provide insights into technological implications and align CBDC design with policy goals.

Narrowing Down the Options: The Prototype

Progressing from PoCs, the Innovation Phase leads to developing a CBDC prototype. This marks the initial step toward an eventual CBDC launch. During this phase, countries select technology platforms and design features that align with their policy objectives. The prototype undergoes continuous experimentation involving representative stakeholders.

The decision to initiate a prototype does not imply immediate CBDC issuance. Instead, it enhances understanding of CBDC impacts, risks, and alignment with policy goals.

Real-Life Testing: The Pilot

The Pilot phase represents the real-life testing of the CBDC prototype. In this stage, real-value CBDCs are issued and used for actual economic transactions on a limited scale. Comprehensive tests evaluate scalability, maintenance, and risk management to ensure CBDCs effectively achieve policy objectives.

Countries make informed decisions about the scale and duration of the pilot, minimizing risks while obtaining conclusive results. Continuous engagement with stakeholders shapes CBDC refinement.

The Path Forward

The Innovation Phase signifies a transformative stage in CBDC development. It’s a dynamic process where experimentation, testing, and refinement pave the way for digital currency innovation. As countries navigate this intricate landscape, they strengthen their understanding of CBDC impacts and readiness, ensuring a robust foundation for potential issuance.

Launching the CBDC: The Production Phase

Now, as our exploration of Central Bank Digital Currencies (CBDCs) reaches a pivotal juncture, we enter the Production Phase—a culmination of rigorous planning and testing. This phase marks the launch of CBDCs, offering a glimpse into the real-world applications of digital currencies.

Formal Launch and Ongoing Management

The Production Phase commences with the formal launch of the CBDC. Only a handful of jurisdictions worldwide have entered this phase, including The Bahamas, Jamaica, and Nigeria. While practical experience in this phase remains limited, central banks can draw upon insights from operating other payment systems and the knowledge accumulated in earlier phases.

This phase is open-ended, continuing until a decision is made to terminate it. It represents a continuation of the previous stages, demanding ongoing evaluation, iteration, and improvement based on real-world experience.

Decision-Making in the Production Phase

The decision to initiate the Production Phase is a jurisdiction-specific choice. However, a structured methodology, guided by meticulous testing across all preceding phases, minimizes risks and provides a solid foundation for decision-making.

Achieving adequate CBDC adoption aligns with policy objectives, and the definition of “adequate” may vary depending on these objectives. Central banks must consider the level of adoption required, incorporating this analysis into their Key Performance Indicators (KPIs).

Promoting Adoption and Stakeholder Engagement

Sufficient adoption depends on understanding the needs of users and Payment Service Providers (PSPs). This understanding, rooted in the Preparation Phase, is continually nurtured through stakeholder engagement. PSPs can promote CBDC adoption if clear incentives align with their interests.

Throughout the Production Phase, central banks adhere to principles established in earlier stages. CBDCs remain dynamic, evolving to stay relevant in the ever-changing digital landscape. Ongoing innovation, regular evaluations, and potential tweaks to the CBDC’s design ensure it meets changing needs.

Areas of Ongoing Evaluation

Several areas require continuous evaluation during the Production Phase:

- Operational Resilience: Extensive testing confirms that the CBDC is scalable and resilient to cyberattacks and operational challenges. Robust recovery plans meeting established payment system standards must be in place.

- Design Adequacy: The CBDC’s design must consistently align with policy objectives and mitigate risks. Any perceived inadequacies can be gradually addressed through improvements and further Proof of Concepts (PoCs).

- Reception and Adoption: Frequent communication and stakeholder analysis remain pivotal for achieving and sustaining suitable adoption levels. Understanding why potential users may not be interested in CBDCs informs design and communication adjustments.

Continued Progress Toward Digital Transformation

As countries venture into the Production Phase, they embark on a journey to reshape the financial landscape. CBDCs represent a transformative force, and their successful launch requires an unwavering commitment to robustness, adaptability, and stakeholder engagement.

Our exploration of CBDC development has provided insights into each phase of this groundbreaking endeavor. Stay tuned as we unravel the path to a digital currency future that promises innovation, efficiency, and financial inclusion. The road ahead is illuminated by the promise of digital transformation, and the possibilities are limitless.

Stay informed, stay ahead, and continue your learning journey with MASEconomics!