Game theory provides a powerful lens to understand strategic decision-making in economics. From pricing strategies among firms to complex negotiations between nations, game theory uncovers the dynamics of competition and cooperation in diverse environments. Unlike standard optimization techniques, game theory emphasizes that decisions are interdependent—each player’s success depends not only on their choices but also on the actions of others.

This article explores key concepts in game theory, including Nash equilibrium, dominant strategies, the prisoner’s dilemma, and the role of sequential games. These tools offer valuable insights into how firms behave in oligopolies, the challenges of cooperation, and how competition plays out in the real world.

Game Theory Concepts: A Snapshot of Strategic Behavior

| Concept | Definition | Real-World Example |

|---|---|---|

| Nash Equilibrium | A situation where no player can improve their outcome by unilaterally changing their strategy, assuming others maintain theirs. | Competing firms in an oligopoly both set low prices to maintain market stability, even though both would benefit from higher prices. |

| Dominant Strategy | A strategy that provides the highest payoff for a player, regardless of the strategies chosen by other players. | In the prisoner’s dilemma, both prisoners choose to confess, as it provides the best individual outcome, regardless of the other’s decision. |

| Prisoner’s Dilemma | A situation where rational choices by individuals lead to a collectively worse outcome compared to cooperation. | Firms in an oligopoly engage in price wars to capture market share, leading to lower profits for all competitors. |

| Sequential Games | Games where players make decisions in a sequence, with later players observing earlier moves. | In the Stackelberg model, one firm acts as a leader, setting output first, followed by other firms. |

| Backward Induction | A problem-solving technique for sequential games, working backward from the final decision to determine optimal strategies at earlier stages. | A leader firm in a Stackelberg oligopoly uses backward induction to predict follower firms’ responses and maximize profits. |

|

||

What Is Game Theory?

At its core, game theory is the study of strategic interactions, where each player’s outcome depends on the actions of others. Unlike decision-making frameworks that assume independent choices, game theory examines how individuals or firms make decisions when they cannot ignore their competitors’ actions.

A “game” consists of:

- Players: Decision-makers in the game (e.g., firms, consumers, or governments).

- Strategies: A set of possible actions each player can take.

- Payoffs: The outcomes resulting from different combinations of strategies.

Game theory can be applied in various economic contexts, including price-setting in oligopolies, international trade agreements, and advertising strategies. By modeling these interactions mathematically, game theory helps economists predict outcomes and understand the incentives driving firm behavior.

Nash Equilibrium

The Nash Equilibrium, introduced by mathematician John Nash, is a crucial concept in game theory. It describes a situation in which no player can improve their outcome by changing their strategy unilaterally, provided that the other players maintain their strategies. This equilibrium ensures that all participants are making the best possible decisions, given the actions of others.

The Mathematics Behind Nash Equilibrium

If \( S \) represents the set of all possible strategies for each player, a strategy profile \( (s_1, s_2, \dots, s_n) \) is in Nash Equilibrium if:

\( u_i(s_i^*, s_{-i}) \geq u_i(s_i’, s_{-i}) \quad \forall s_i’ \in S_i \)

Here’s what each element means:

- \( u_i \) denotes the utility (payoff) for player \( i \).

- \( s_i^* \) refers to the equilibrium strategy for player \( i \).

- \( s_{-i} \) captures the strategies chosen by all other players.

In simple terms, each player’s strategy is optimal, given the strategies of the others. Any deviation from this strategy would result in a worse outcome for the player making the change.

Practical Example: Price Competition

Consider two competing firms, Firm A and Firm B, choosing between high and low prices for their products. Their payoffs are as follows:

| Firm A’s Strategy | Firm B’s Strategy | |

|---|---|---|

| High Price (B) | Low Price (B) | |

| High Price (A) | (100, 100) | (50, 150) |

| Low Price (A) | (150, 50) | (80, 80) |

|

||

- If both firms set low prices, the payoff is (80, 80).

- If both set high prices, the payoff is (100, 100).

- Setting different prices leads to an imbalance—one firm earns a higher profit while the other earns less.

The Nash Equilibrium occurs when both firms set low prices (80, 80). Although the outcome is not ideal (compared to 100, 100), neither firm can improve its payoff by unilaterally changing to a high price. This reflects the stability of Nash Equilibrium—no player has an incentive to deviate.

Real-World Implications of Nash Equilibrium

In markets like oligopolies, Nash Equilibrium helps explain why firms may avoid aggressive price wars. Even though cooperation could lead to better outcomes (such as high prices for all firms), the fear of unilateral deviation forces firms to settle for a suboptimal but stable equilibrium. Nash Equilibrium is widely used in auction theory, bargaining models, and network pricing scenarios.

Dominant Strategies

A dominant strategy is a strategy that yields the highest payoff for a player, regardless of the strategies chosen by others. If a player has a dominant strategy, they will always choose it because it guarantees the best outcome, no matter how their competitors act.

Formal Definition

In a strategic game, strategy \( s_i \) for player \( i \) is dominant if:

This means that strategy \( s_i \) always produces the highest utility for player \( i \), irrespective of the other players’ strategies.

Example: Dominant Strategies in Pricing

Consider the earlier pricing example. If Firm A consistently earns higher profits by choosing a low price—regardless of whether Firm B sets a high or low price—then a low price is Firm A’s dominant strategy. The same logic applies to Firm B.

- When both firms adopt their dominant strategies, the outcome is the Nash Equilibrium (80, 80).

- Even though this equilibrium is not the best possible outcome, it is predictable because each firm chooses its dominant strategy.

Real-World Application: Predictability and Dominance

The presence of dominant strategies makes certain outcomes predictable. For example:

- In oligopolies, dominant strategies can lead to price wars as firms undercut each other to gain market share.

- In game shows or auctions, contestants often choose dominant strategies to maximize their chances of winning.

However, not all games have dominant strategies. In many real-world situations, players must carefully analyze the actions of their competitors to determine their optimal strategy. Nash Equilibrium is particularly useful when dominant strategies are absent, as it provides a stable solution even in more complex games.

The Prisoner’s Dilemma

The prisoner’s dilemma is a classic example in game theory that demonstrates how individual rationality can lead to a collectively worse outcome. It explores the tension between cooperation and self-interest, revealing why players often fail to achieve the best possible outcome for all.

Setup of the Prisoner’s Dilemma

Imagine two prisoners, A and B, who are arrested and interrogated separately. Each prisoner has two options:

1. Remain Silent (Cooperate)

2. Confess (Betray the Other)

The outcomes are as follows:

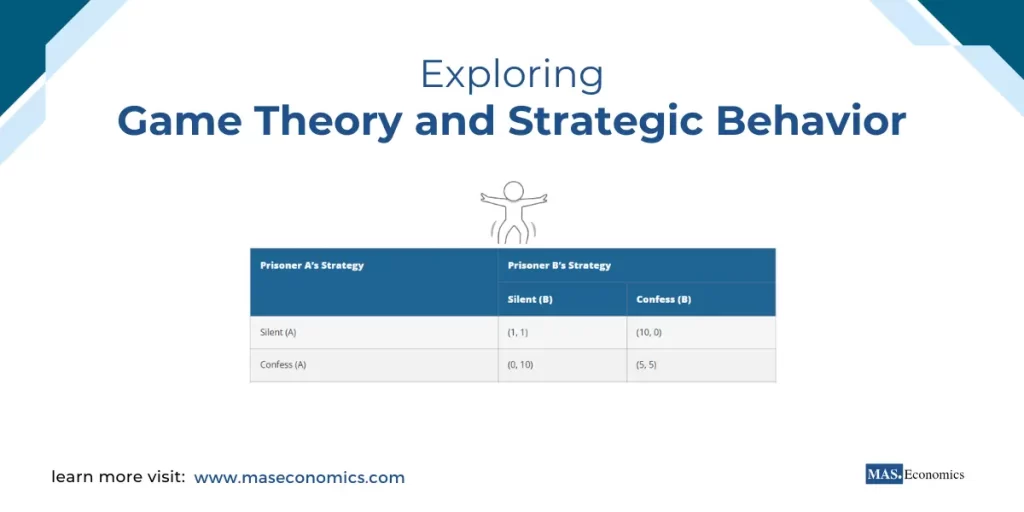

| Prisoner A’s Strategy | Prisoner B’s Strategy | |

|---|---|---|

| Silent (B) | Confess (B) | |

| Silent (A) | (1, 1) | (10, 0) |

| Confess (A) | (0, 10) | (5, 5) |

|

||

- If both remain silent, they each serve 1 year.

- If one confesses and the other remains silent, the confessor goes free, while the other serves 10 years.

- If both confess, they each serve 5 years.

The Dilemma Explained

The dominant strategy for both prisoners is to confess since confessing offers a better outcome, no matter what the other prisoner does. However, when both choose to confess, the outcome is worse (5 years each) than if both had remained silent (1 year each).

This dilemma highlights how rational decisions can lead to suboptimal outcomes. Cooperation would have resulted in a better outcome for both, but the lack of trust and fear of betrayal drove both to confess.

Application of the Prisoner’s Dilemma in Economics

The prisoner’s dilemma is widely used to analyze:

- Price wars in oligopolies: Competing firms might lower prices to capture market share, even though maintaining higher prices would benefit all.

- Trade negotiations: Countries may impose tariffs to protect domestic industries, despite knowing that free trade benefits all parties.

- Environmental policies: Nations may avoid cutting emissions, fearing that others will not comply, leading to collective harm.

In each of these situations, cooperation would yield better outcomes for everyone, but individual incentives drive firms or nations toward suboptimal decisions.

Repeated Prisoner’s Dilemma and the Role of Trust

In real-world interactions, the prisoner’s dilemma is often repeated, allowing players to adjust their strategies over time. Trust and cooperation can emerge through repeated interactions, as players learn that cooperation leads to better long-term outcomes. This concept is particularly relevant in collusive agreements among firms and international diplomacy, where repeated interactions encourage compliance.

Sequential Games and Backward Induction

While the prisoner’s dilemma and Nash Equilibrium focus on simultaneous decisions, many real-world interactions involve sequential decisions. In sequential games, players take turns making moves, with later players having some knowledge of earlier actions.

How Backward Induction Works

Backward induction is a method used to solve sequential games by working backward from the end of the game to determine the optimal strategy at each stage. This approach helps players anticipate future actions and optimize their current decisions.

Example: Stackelberg Model of Oligopoly

In the Stackelberg model, one firm (the leader) sets its output first, while the other firm (the follower) responds based on the leader’s decision. By moving first, the leader gains a strategic advantage. Using backward induction, the leader firm can predict how the follower will react and choose its output to maximize profits.

Backward induction is essential in industries where first-mover advantage plays a crucial role. Firms that move early can lock in market share or establish brand loyalty, making it harder for competitors to catch up.

Conclusion

Game theory offers powerful tools for understanding how firms and individuals behave in competitive situations. Concepts like Nash Equilibrium, dominant strategies, and the prisoner’s dilemma highlight the challenges of cooperation and competition. Sequential games demonstrate the importance of timing and foresight in strategic interactions, showing how firms can anticipate rivals’ actions to gain a competitive edge.

FAQs:

What is game theory, and why is it important in economics?

Game theory studies strategic interactions where outcomes depend on the actions of multiple decision-makers. It is crucial in economics to analyze pricing strategies, trade negotiations, and market behaviors, especially in competitive or cooperative settings.

What is a Nash equilibrium?

Nash equilibrium occurs when no player can improve their outcome by changing their strategy, provided others stick to theirs. It explains stable outcomes in competitive markets where firms optimize their strategies based on rivals’ actions.

How do dominant strategies work in game theory?

A dominant strategy is the best choice for a player, regardless of what others do. If a firm has a dominant strategy, it will always choose it, leading to predictable behavior in competitive settings, such as price wars.

What is the prisoner’s dilemma, and how does it apply to economics?

The prisoner’s dilemma illustrates how rational choices can result in suboptimal outcomes for all parties. In economics, it explains why firms engage in price wars or why countries fail to cooperate on environmental policies despite mutual benefits from collaboration.

How does repeated interaction affect the prisoner’s dilemma?

In repeated prisoner’s dilemmas, trust can build over time, encouraging cooperation. Players learn that working together leads to better long-term outcomes, which applies to trade negotiations, collusion, and diplomatic relations.

What are sequential games, and how do firms use backward induction?

Sequential games involve decisions made in sequence, with each player observing previous moves. Firms use backward induction to predict competitors’ actions and optimize their own, gaining a strategic advantage, as seen in the Stackelberg model of oligopoly.

How does game theory explain firm behavior in oligopolies?

Game theory models help explain why firms in oligopolies might avoid price wars despite potential benefits from higher prices. Nash equilibrium shows that even if cooperation would lead to better outcomes, fear of defection keeps firms in stable but suboptimal strategies.

What is the difference between simultaneous and sequential games?

Simultaneous games require players to act at the same time, without knowing others’ moves, as in Nash equilibrium. In sequential games, players act one after another, allowing them to adapt strategies based on earlier decisions.

How does game theory influence pricing strategies?

Game theory helps firms determine optimal pricing by anticipating competitors’ actions. For instance, firms in oligopolies use it to decide whether to maintain high prices or lower them to capture market share.

What are real-world applications of game theory?

Game theory applies to various scenarios, including auctions, trade negotiations, pricing strategies in oligopolies, and environmental policy-making, offering insights into how strategic decisions impact market outcomes and cooperation.

Thanks for reading! Share this with friends and spread the knowledge if you found it helpful.

Happy learning with MASEconomics