Introduction

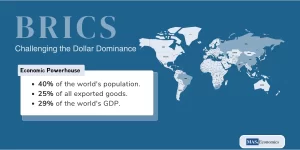

Many economists believe that globalization helps to stimulate financial development in countries. This, in turn, can help reduce poverty and inequality by stimulating economic growth. It allows poor people to access credit from banks and to improve their education and skills.

This can lead to increased productivity and economic growth. Thus, It may be a way to reduce poverty in countries in transition, such as Pakistan, Poland, and Kazakistan.

Financial development has been typically measured by variables such as private credit to GDP or public debt to GDP. However, this does not accurately reflect how banks have changed their practices in recent years. With globalization, banks have increased their involvement in securities trading, such as foreign exchange and derivatives markets. This altered behavior should be considered when measuring a nation’s financial development.

A relatively low level of financial development, in the form of poor financial infrastructure and a weak financial system, acts as a severe constraint on economic growth. This is because there are not enough good banks or other places for people to put their money, so businesses cannot get the loans they need to start up and grow.

It helps to facilitate the allocation of resources in an economy, especially when financial markets are underdeveloped. Globalization has increased access to funds, stimulating financial development.

Advantages

The benefits of globalization include the development of the financial sector, technology and know-how transfer, and the provision of lower capital costs. Additionally, globalization enables improvements in macroeconomic policies and institutions.

Increased competition among banks and other financial institutions leads to improved consumer services and products. This increased competition has led to improved services and products for consumers.

Greater access to capital from around the world allows businesses to grow and expand more efficiently. More effortless transfer of money and investment funds helps promote economic growth in developing countries.

This is because it becomes more accessible for people in those countries to access the money they need to start or grow businesses. This can help increase the overall economic output of those countries, which can lead to improved living conditions for the people.

Information sharing and communication help a business react more quickly to changes in the market. This means the business can use its resources more efficiently to get better results.

Economic globalization is beneficial for financial institutional development in countries. It allows countries to access resources and capital while also allowing them to learn from other nations. Countries can foster greater economic growth and diversification by taking advantage of these opportunities.

Downsides

However, it is argued that there are significant downsides that come with this process – one being an unprecedented increase in income disparities between both developed and developing countries.

An increase in cross-border financial flows has contributed to increased exposure of individual economies to international shocks. Financial integration benefits emerging markets because it can lead to higher economic growth rates through improved resource allocation.

However, this exposure makes them more susceptible to currency crises that stem from capital market imperfections or external shocks. Without strong institutions that can detect these risks early, policymakers struggle to ensure optimal macroeconomic outcomes during periods of uncertainty.

Academic findings on Financial development

Over the past three decades, globalization has led to institutional reforms that promote financial stability and economic growth. This, in turn, has strengthened the link between financial institutional development and globalization. In other words, globalization may indirectly enhance economic growth by promoting financial development (Mishkin, 2009).

Rodrik (1998) suggests that underdeveloped financial markets can be attributed to poor government institutions, where officials may engage in corrupt practices, which compromise sound economic decision-making.

A lack of political will or poorly designed institutions may further complicate the task of policymakers who want to initiate financial liberalization policies. Developed financial systems tend to have a greater degree of security trading, which enhances long-term growth performance.

According to Balcilar et al. (2019), the way globalization affects financial institutions in various countries is not always positive, as some belief. Their study of 36 nations found that it unevenly impacts different parts of economic growth. Globalization’s effect also differs depending on factors such as where a country is located and how developed its infrastructure is. Policymakers need to consider these details when developing ways to bolster financial development among institutions within their own countries.

Boden et al. (2016) found that less economically developed nations have a harder time maintaining and creating new affiliates, which harms their sales domestically and internationally. Additionally, local businesses are being outperformed by their competition because they have limited resources. The study examined how financial reforms affecting multinational firms can bring advantages to host countries and domestic businesses in those nations. By promoting an overall increase in multinational corporation activity and fostering greater entry into new markets by smaller local companies, such changes can have a broad and beneficial impact.

Furthermore, new research suggests that financial conditions in a host country can shape multinational firms’ global operations. This is done by influencing their access to local capital and where they produce and sell their goods. The competition effect highlighted in the paper relates to how multinationals can crowd out local producers by raising competition. However, they can also generate productivity spillovers and nudge indigenous companies to remove X-inefficiencies (Bilir et al. (2019).

Recommendation

Although Globalisation has fostered faster economic growth, it has also produced greater risk at the international level. Financial crises have occurred more frequently in connected economies than in isolated ones.

That is why policies stimulating local banking connections may be necessary before opening up to international capital flows. They might also help mitigate income inequality by stimulating efficient credit allocation mechanisms that eliminate information asymmetries between borrowers and lenders, resulting in improved opportunities for SMEs generally considered to have high wealth-creating ability but more difficulty accessing finance.

Financial liberalization is a double-edged sword; countries must ensure they can control both the direction and pace of their future growth.

Conclusion

Globalization has benefits and drawbacks when it comes to financial development. It can help stimulate growth in developing countries. However, it has also produced greater risk at the international level. Financial crises have occurred more frequently in connected economies than in isolated ones. That is why policies stimulating local banking connections may be necessary before opening up to international capital flows. They could also help reduce income inequality by triggering effective credit allocation methods that remove information imbalances between borrowers and lenders, resulting in better opportunities for SMEs often thought to have high wealth-creating ability but more difficulty accessing finance.

References:

Balcilar, M., Gungor, H., & Olasehinde-Williams, G. (2019). On the impact of globalization on financial development: a multi-country panel study. European Journal of Sustainable Development, 8(1), 350-350.

Bilir, L. K., Chor, D., & Manova, K. (2019). Host-country financial development and multinational activity. European Economic Review, 115, 192-220.

Merits of financial market development for developing countries. (2016, August 23). CEPR. https://cepr.org/voxeu/columns/merits-financial-market-development-developing-countries

Mishkin, F. S. (2009). Globalization and financial development. Journal of development Economics, 89(2), 164-169.