In economics, analyzing large datasets is fundamental to understanding the relationships between different variables. Whether determining how consumer spending reacts to changes in income or evaluating the impact of education on productivity, these relationships require structured data representation and efficient computation. Vectors and matrices are the mathematical backbone that makes this possible. Using vectors and matrices, economists can simultaneously handle multiple equations, simplify complex data analysis, and make sense of the relationships between multiple variables.

What are Vectors and Matrices?

To understand their application in economics, we must first define what vectors and matrices are:

Vectors

A vector is essentially an ordered list of numbers. In economics, vectors are used to represent variables that are associated with multiple data points. For example, if we want to represent the monthly household income of five families, we can use a vector such as:

Here, each element in the vector represents the income of one family. Vectors are an important building block in economic modeling because they allow us to handle multiple variables simultaneously and observe changes across different entities.

Matrices

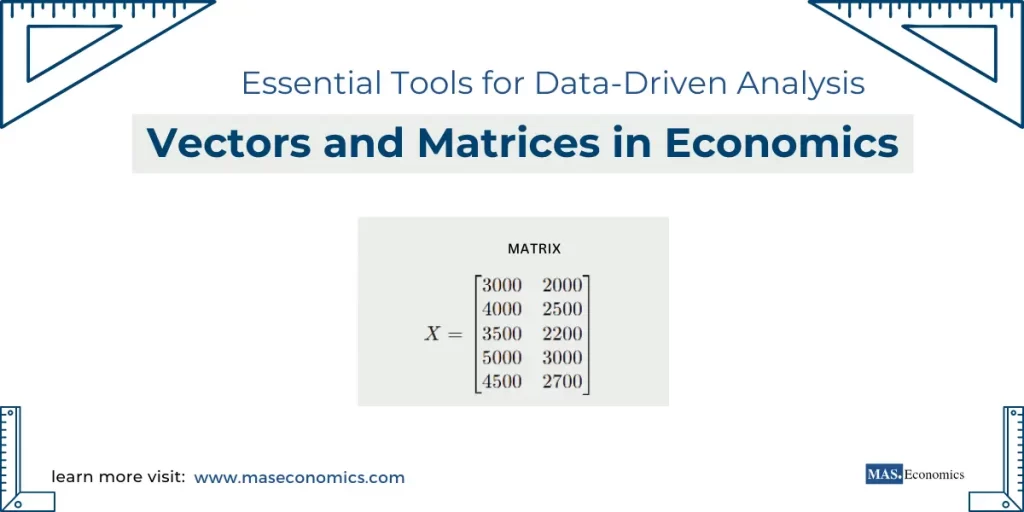

A matrix is a two-dimensional array of numbers, with rows and columns. Matrices are extensively used in econometrics to represent data with multiple variables across numerous observations. For instance, if we want to analyze both the income and expenditure of five families, we could use a matrix like this:

In this matrix, each row represents a family, and each column represents a variable—income and expenditure, respectively. Matrices are the cornerstone of multivariate analysis, enabling economists to deal with large, complex datasets.

Applications of Vectors and Matrices in Economic Analysis

Representing Economic Data

Vectors and matrices are fundamental tools for representing economic data. For instance, GDP data across multiple countries, or labor force data segmented by industry, can be organized in a matrix to facilitate easy comparison and analysis. By arranging data in matrix form, we can perform a variety of operations, such as aggregating data, computing averages, or identifying patterns across different groups.

Solving Systems of Linear Equations

Economists often need to solve systems of linear equations to understand how different variables interact. For example, in analyzing a market equilibrium, we often deal with simultaneous equations for supply and demand. A system of equations can be represented in matrix form:

Where \(A\) represents the coefficients of different variables, \(X\) is the vector of unknowns (such as quantities or prices), and \(B\) represents constants (such as total supply or demand). Matrices enable the efficient solving of these systems, especially when the number of equations and unknowns becomes large.

Matrix Operations in Econometrics

In econometrics, the relationship between variables is frequently analyzed using regression models. The data from multiple variables are often represented in matrix form to simplify computations. For example, consider a multiple linear regression model with \(n\) observations and \(k\) independent variables. We can express the model as:

- \(Y\): A vector representing the dependent variable (e.g., consumption levels).

- \(X\): A matrix of independent variables (e.g., income, education level, employment status).

- \(\beta\): A vector of coefficients that represent the relationship between each independent variable and the dependent variable.

- \(\epsilon\): A vector of error terms, representing the deviation of actual observations from the predicted values.

Matrix operations allow for the efficient estimation of the vector \(\beta\) using methods such as Ordinary Least Squares (OLS), which minimizes the sum of squared residuals (differences between observed and predicted values). The equation for estimating the coefficients in matrix form is:

Where \(X^T\) represents the transpose of the matrix \(X\), and \(\left( X^T X \right)^{-1}\) is the inverse of the product of the transpose and the original matrix. This concise representation allows economists to work with large datasets and multiple variables efficiently.

Linear Regression and Economic Relationships

Understanding Linear Regression

Linear regression is one of the most common applications of matrices in econometrics. It involves modeling the relationship between a dependent variable and one or more independent variables. For example, an economist might use linear regression to understand how education level, income, and work experience impact an individual’s consumption habits.

The use of matrices makes the linear regression process more efficient, particularly when dealing with large datasets involving many observations and variables. Each observation in a dataset can be represented as a row in the matrix \(X\), with each variable represented by a column. The matrix approach allows all computations to be done simultaneously, speeding up the estimation process and reducing the likelihood of errors.

Example: Impact of Education on Income

Consider a linear regression model where we are interested in the impact of education (in years), work experience, and age on individual income. Our dataset includes these three variables for 100 individuals. We can represent the data in a matrix \(X\) with 100 rows (each row representing an individual) and 3 columns (representing education, experience, and age).

The matrix \(X\) allows us to calculate the impact of each independent variable on income by estimating the coefficients in the vector \(\beta\). By using matrix operations, we can determine which factors have the greatest influence on income, and use this information to develop effective policy recommendations.

Importance of Vectors and Matrices in Economic Data Analysis

Efficiency and Scalability

One of the key reasons why vectors and matrices are so crucial in economic data analysis is their efficiency and scalability. Matrices enable economists to handle massive datasets involving multiple variables and thousands of observations, which would be impractical to analyze using individual equations. With the power of matrix algebra, computations such as regression analysis can be performed much faster, which is crucial for real-time policy analysis and decision-making.

Simplification of Complex Problems

Matrices also help in simplifying complex economic problems. For example, consider an input-output model of an economy, which describes how different sectors interact in terms of inputs and outputs. These relationships can be organized into a matrix, where each element shows the input requirements of one sector from another. By representing these interactions in a matrix, it becomes easier to analyze the interdependencies between sectors, predict the effects of changes in production, and identify key industries for economic growth.

Data Transformation and Principal Component Analysis (PCA)

Beyond regression, matrices are also used in advanced econometric techniques such as Principal Component Analysis (PCA), which is used to reduce the dimensionality of data. In large datasets, PCA uses matrix operations to transform the data into a new coordinate system, allowing economists to identify the main drivers of variation in the dataset. This can be particularly useful in macroeconomic analysis, where numerous variables might interact, and understanding the primary factors can help focus analysis and policy interventions.

Conclusion

Vectors and matrices are more than just mathematical constructs—they are powerful tools that enable economists to make sense of complex data, understand relationships between variables, and predict outcomes based on observed trends. From representing economic data in an organized manner to solving systems of linear equations, their applications are vast and crucial for modern economic analysis.

In econometrics, linear regression models built on matrix algebra are indispensable for analyzing economic relationships.

FAQs:

What are vectors and matrices, and how are they used in economics?

Vectors are ordered lists of numbers representing variables, such as household incomes across multiple families. Matrices are two-dimensional arrays used to store and analyze multiple variables across different observations, such as income and expenditure for a group of families. Both are essential in economic analysis, facilitating efficient data management and complex calculations.

How do matrices simplify the analysis of economic data?

Matrices allow for the organization of large datasets, enabling economists to represent data with multiple variables and observations compactly. Operations such as averaging data, finding patterns, or running regressions become more manageable by structuring data as matrices. This scalability is especially valuable when handling thousands of observations.

How are vectors and matrices used in solving systems of linear equations?

In economics, many models require solving systems of linear equations, such as supply and demand models. These equations can be represented using matrices, where matrix algebra enables efficient solutions. If \(A\) is a matrix of coefficients, \(X\) is the vector of unknowns, and \(B\) is the vector of constants, the system \(AX = B\) can be solved using matrix operations like inversion.

What role do matrices play in linear regression analysis?

In econometrics, matrices are crucial for representing and estimating linear regression models. A typical regression model \( Y = X\beta + \epsilon \) can be expressed in matrix form, where \( Y \) is the dependent variable, \( X \) is the matrix of independent variables, \( \beta \) is the coefficient vector, and \( \epsilon \) is the error term. The Ordinary Least Squares (OLS) estimation of \( \beta \) is given by \( \hat{\beta} = (X’X)^{-1}X’Y \).

How do matrices enhance the efficiency of data analysis?

Matrices allow for simultaneous calculations across large datasets, minimizing computational time and reducing errors. For example, in regression analysis with many variables, the matrix representation enables the simultaneous computation of coefficients, making the analysis more efficient compared to solving each equation individually.

How are matrices applied in input-output models of an economy?

In input-output models, matrices capture the interdependencies between sectors of an economy. Each element in the matrix represents the input required by one sector from another. This matrix structure allows economists to analyze how changes in one sector affect others, forecast production changes, and identify key industries driving economic growth.

What is the role of matrices in advanced techniques like Principal Component Analysis (PCA)?

PCA uses matrices to reduce the dimensionality of large datasets by transforming the data into a new coordinate system. This technique helps economists identify the most significant factors driving variation in the data, allowing for focused analysis and efficient policy recommendations.

Why are vectors and matrices essential for economic research and policy-making?

Vectors and matrices are indispensable for their ability to manage complex datasets, solve systems of equations, and perform statistical analyses efficiently. They provide economists with the tools to understand economic relationships, forecast trends, and design data-driven policies. Without these mathematical constructs, modern econometrics and large-scale economic analysis would be significantly more challenging.

Thanks for reading! Share this with friends and spread the knowledge if you found it helpful.

Happy learning with MASEconomics