What is Central Banking?

Central banking is the system of managing a country’s money supply and regulating financial institutions to ensure economic stability. The central bank controls interest rates and the amount of currency available in circulation, often through various economic policies and interventions.

While central banks have been around for centuries, their development over time was shaped by key historical events such as wars, national crises, and technological advancements. Many of these factors led to rapid changes in how central banks operated or even influenced whether they were established in certain countries.

History of Central Banks

The origins of central banks can be traced back to Europe during the 17th century when merchants began issuing paper notes alongside gold and silver coins to supplement their trading activities. As more and more people began using these notes, it soon became apparent that a system was needed to regulate their circulation and ensure that they were backed by real money.

In 1668, the first central bank established was the Riksbank of Sweden. Then Bank of England was established by King William in 1694 to lend to the British government to finance its war against France. This institution was critical in funding the country’s military efforts during the Seven Years’ War, which helped solidify its position as an influential European country.

Other European countries eventually followed suit, establishing similar central banking systems during this period. The Bank of France was established in 1800, and the Netherland Bank in 1814.

In 1791, the First Bank of the United States was established to refinance the war-related debt accumulated by different states; for the same purpose, and the second Bank of the U.S was established in 1816.

However, even though these institutions were established with good intentions, many devolved into corrupt entities that manipulated monetary policy for their gain. For example, starting around 1815, many of these central banks began financing the governments of their respective countries to fund military conflicts.

Functions of Modern Central Banks

Technological advancements throughout the 19th and 20th centuries played an essential role in transforming modern central banking. To achieve their objectives, central banks perform both primary and secondary functions:

Primary Functions

- Issue and manage the national currency

- Formulate and implement monetary policy.

- Regulate and supervise the financial system.

- Foster a safe and efficient payment system.

Secondary Functions

- Foreign exchange management

- Advisor and banker to the government

- Non-traditional development role

Today, nearly every country has its central bank, which plays a crucial role in regulating financial markets and ensuring economic stability. Despite recent challenges, such as the global financial crisis, central banks remain among the world’s most important economic institutions, vital to the stability and growth of national economies.

The Federal Reserve System of the United States

The Federal Reserve, commonly known as “the Fed,” is the central bank of the United States, established in 1913 by an act of Congress. Its primary responsibilities include providing financial services to the U.S. government, regulating member banks, and executing monetary policy.

The Federal Reserve System consists of:

- 12 Regional Federal Reserve Banks: Each serves a specific geographic region of the country.

- The Board of Governors: Located in Washington, D.C., the Board is the Fed’s policymaking body.

Historical Background

The first central bank chartered by the U.S. Congress was the First Bank of the United States, which opened in 1791. Its charter expired after 20 years, and in 1816, Congress chartered the Second Bank of the United States. However, the charter of the second bank was not renewed in 1836, leading to its closure in 1841.

The Creation of the Federal Reserve

The Panic of 1907 highlighted the need for a central institution that could provide liquidity during financial crises. In 1910, a group of bankers secretly met on Jekyll Island, Georgia, to further discuss establishing such an institution. Their efforts resulted in the Federal Reserve Act of 1913, which created the Federal Reserve System.

Functions of the Federal Reserve Bank

The Federal Reserve is responsible for several critical functions:

Regulating Member Banks

The Fed supervises and examines state-chartered banks that are members of the Federal Reserve System. These banks must follow specific regulations, including maintaining a required percentage of assets in reserve to ensure liquidity.

Conducting Monetary Policy

The Fed manages the money supply and credit in the economy by adjusting interest rates and employing other monetary tools. These actions influence economic activity and control inflation.

Providing Financial Services to the Government

The Fed acts as the banker for the U.S. Treasury, processing tax payments and issuing debt securities.

Structure of the Federal Reserve System

The Federal Reserve System, created under the Federal Reserve Act of 1913, comprises:

The Central Bank (Federal Reserve Board): Sets monetary policy and oversees the banking system.

12 Regional Federal Reserve Banks: Supervise member banks, conduct economic research, and help implement monetary policy at the local level.

A Network of Private Banks: Provide capital to the banking system and assist in clearing checks and processing electronic payments.

The Federal Reserve has a dual mandate to promote maximum employment and stable prices. To achieve these goals, the Fed utilizes three primary tools:

Discount Rate: The interest rate at which commercial banks can borrow funds directly from the Fed.

Open Market Operations: The buying and selling of government securities to influence the money supply.

Reserve Requirements: The proportion of customer deposits that banks are required to hold as reserves.

The Federal Open Market Committee (FOMC)

The Federal Open Market Committee (FOMC) is responsible for setting the direction of monetary policy. It consists of:

- Five of the 12 Regional Bank Presidents.

- Seven Members of the Board of Governors.

The FOMC meets eight times a year to discuss the economy, review monetary policy, and make key decisions affecting interest rates and the money supply.

What is Monetary Policy?

Monetary policy is the process by which central banks, for instance, the Federal Reserve in the United States, control the money supply in an economy. This process can involve several actions, including altering interest rates (Fed’s Fund Rate) and controlling the number of money banks are required to keep on reserve with their central bank. By carefully managing these factors, central banks hope to achieve specific economic goals like price stability and full employment by fully utilizing productive resources.

There are several reasons why monetary policy is so crucial for modern economies. For one thing, controlling the level of money circulating in an economy can significantly impact overall prices.

Maintaining the value of money and promoting the confidence of the public to hold domestic currency

When excessive money is available in an economy, demand increases, and prices rise. Similarly, demand decreases, and prices fall when less money is available. Therefore, modern central banks will often use monetary policy to try and achieve a certain level of inflation or price stability within an economy.

Another important function of monetary policy is controlling borrowing costs for consumers and businesses. Central banks can encourage or discourage borrowing in different parts of the economy by altering interest rates. Low interest rates make it easy for consumers and businesses to borrow money, which can stimulate economic activity by increasing consumer spending and business investment. Conversely, high interest rates make it more expensive for borrowers to take on new debt, which curbs economic activity. As such, central banks frequently use monetary policy to help adjust economic cycles and promote more robust long-term economic growth.

Overall, monetary policy is a crucial tool for central banks as they work to achieve specific economic objectives and promote strong and stable growth. By carefully adjusting interest rates, controlling the money supply, and managing exchange rates, central banks can play an essential role in shaping both short-term conditions and long-term economic growth. While there is always a degree of uncertainty involved in managing monetary policy, this process can be an effective way for central banks to promote the prosperity of their countries and regions.

What are the Objectives of Monetary Policy?

Monetary policy has a dual mandate of ensuring price stability and financial stability. This broad mandate could be interpreted in several ways, but the focus is on keeping inflation within target and the smooth functioning of the financial market.

The objectives of central banks vary from country to country, but they typically include maintaining price stability, promoting economic growth, and providing financial stability.

Central banks use monetary policy to help address issues such as high unemployment or inflation. For example, if the unemployment rate is too high, monetary policymakers may seek to boost aggregate demand by lowering interest rates or increasing the money supply. This should encourage businesses and consumers to spend more money, leading to increased hiring and growth in the overall economy.

In contrast, if the economy is experiencing high inflation, central banks may use monetary policy to raise interest rates or reduce the money supply to slow down the economy and lower inflation. Using tools like these, policymakers can seek to achieve a range of specific goals related to employment, price stability, and overall financial stability.

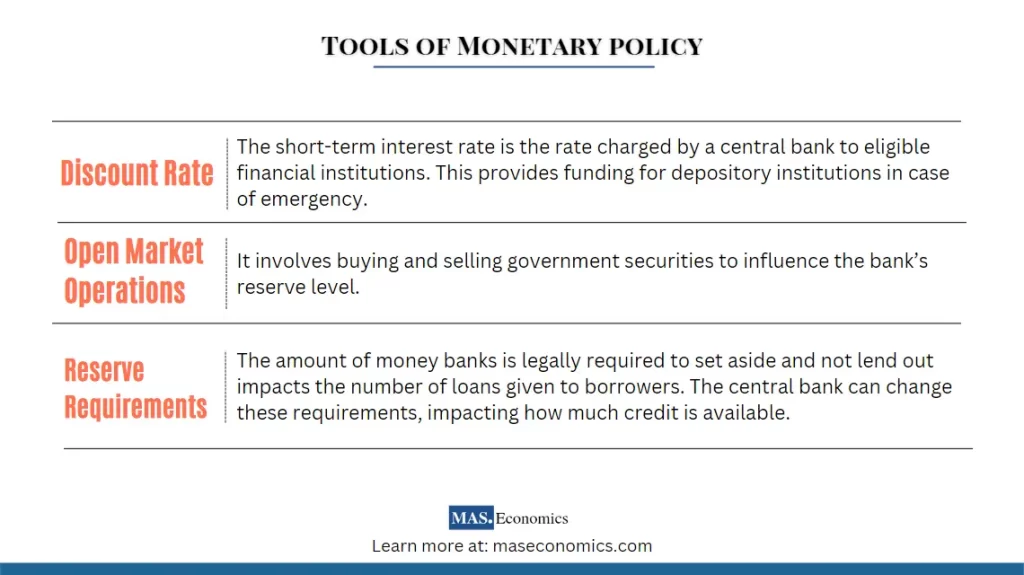

Tools of Monetary Policy

Central banks have both traditional and non-traditional tools at their disposal to conduct monetary policy. The Federal Reserve, as the central bank of the United States, employs a combination of these tools to manage economic stability.

Traditional Monetary Policy Tools

Under normal circumstances, the Federal Reserve uses three primary traditional tools:

Discount Rate

The discount rate is the short-term interest rate charged by a Federal Reserve Bank to eligible financial institutions for backup funding. This rate is set by Reserve Bank boards and approved by the Board of Governors. By adjusting the discount rate, the Fed influences borrowing costs for banks, which in turn affects overall credit conditions in the economy.

Open Market Operations (OMO)

Open market operations involve the buying and selling of government securities to influence the level of reserves in the banking system. By purchasing securities, the Fed adds liquidity to the banking system, encouraging lending and spending. Conversely, selling securities reduces liquidity. Historically, OMOs were the Fed’s primary monetary policy instrument.

Reserve Requirements

Reserve requirements refer to the percentage of deposits that banks are required to hold in reserve and cannot lend out. By altering reserve requirements, the Fed can directly impact the amount of credit that banks extend to borrowers, thereby influencing the money supply.

Non-Traditional Monetary Policy Tools

During times of severe financial crisis, such as the 2007-2008 financial crisis, the Fed turns to non-traditional tools, including:

Asset Purchases

Also known as quantitative easing (QE), asset purchases involve buying longer-term securities to inject liquidity into the economy and lower long-term interest rates.

Lending Facilities

These facilities provide targeted lending to specific sectors or institutions to maintain credit flow and stabilize financial markets.

In response to the COVID-19 pandemic, the Fed once again employed a full range of both traditional and non-traditional tools to ensure that credit continued to flow to households and businesses during this challenging period.

Considerations in the Use of Monetary Policy Tools

While central banks have various tools to manage their economies and achieve specific goals, these tools must be used carefully. Misusing or overusing monetary policy tools can lead to unintended consequences, such as excessive inflation, asset bubbles, or financial instability.

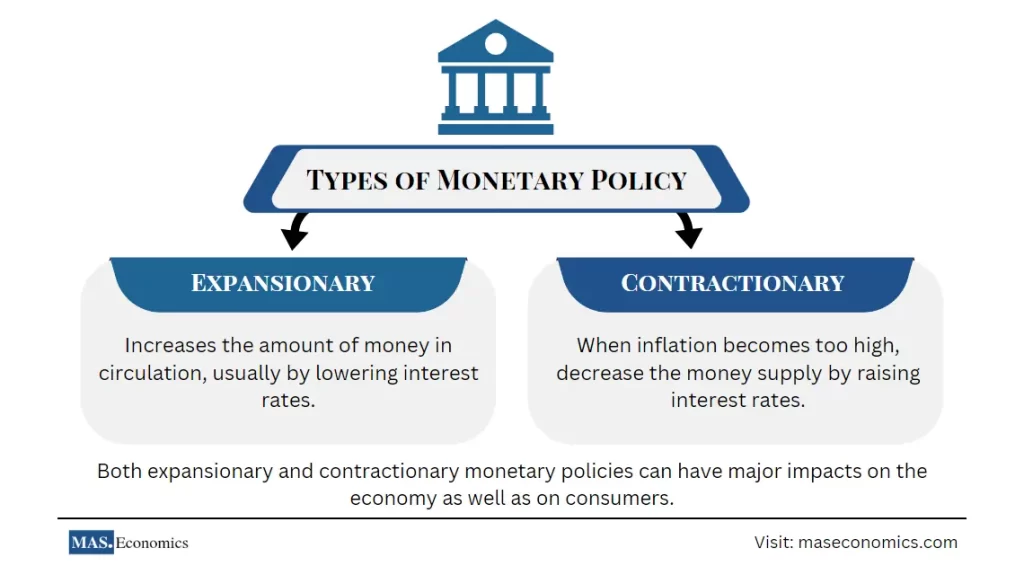

Types of Monetary Policy

Monetary policy can be divided into two main categories: expansionary and contractionary policy.

Expansionary Monetary Policy

Expansionary monetary policy increases the amount of money in circulation, usually by lowering interest rates. This monetary policy typically leads to increased consumer spending and economic growth. Some standard tools used by central banks that implement an expansionary monetary policy are open market operations, discount rate cuts, changes in reserve requirements, and quantitative easing (QE).

Contractionary Monetary Policy

Contractionary monetary policy is used to decrease the money supply by raising interest rates or decreasing the number of money banks can lend to consumers. This type of monetary policy is usually employed when inflation becomes too high or when there are concerns about a recession or financial crisis. Standard tools used by central banks to implement a contractionary monetary policy include open market operations, increases in the discount rate, changes in reserve requirements, and increasing the required amount of reserves that banks must hold.

Both expansionary and contractionary monetary policies can have major impacts on the economy as well as on consumers. For example, lowering interest rates encourages consumers to spend more money and boosts economic growth. However, borrowing becomes cheaper for businesses and consumers, which may lead to higher inflation. On the other hand, raising interest rates usually discourages consumer spending but helps prevent inflation from getting out of control or causing financial problems like bankruptcy.

Additionally, increasing the money supply via quantitative easing (QE) or lowering reserve requirements can increase inflation, but this is a temporary effect.

In the end, understanding the different types of monetary policy is vital for consumers and businesses alike to understand how changes in interest rates or money supply can impact their finances. It also helps explain why central banks use particular tools to achieve specific goals and how those actions may impact economic growth, inflation, unemployment levels, and other factors.

Inflation Targeting

Inflation targeting was introduced in 1997 by Alan Greenspan, who said that our best hope for avoiding deflationary pressures lies in maintaining low and stable inflation. He believed the Federal Reserve could achieve this without tight fiscal policies because he thought the Fed had more tools than raising/lowering interest rates (Greenspan, 1997). It allows policymakers to focus on achieving a particular objective rather than managing multiple objectives simultaneously. The central bank can use monetary policy to offset shocks or events that would otherwise destabilize the economy. Policymakers may concentrate solely on one of these goals, such as unemployment or inflation.

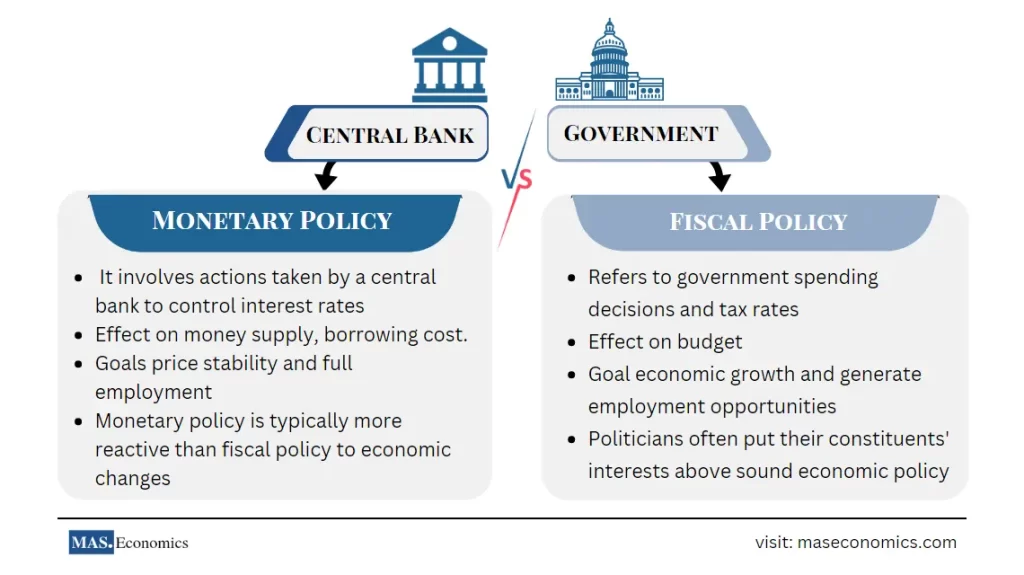

Difference between Monetary policy and Fiscal Policy

Fiscal and monetary policy are two essential tools that governments use to influence the economy. While they may seem similar, the two policies have some key differences.

One significant difference between fiscal and monetary policy is that fiscal policy refers to government spending decisions and tax rates. In contrast, monetary policy involves actions taken by a central bank to control interest rates and money in circulation.

Another critical difference between these two types of policies is that monetary policy tends to be more reactive than fiscal policy. For example, suppose there is an economic downturn or financial crisis. In that case, a central bank will usually respond with changes in interest rates or other measures to influence lending and investment behavior within the private sector.

In comparison, fiscal policy is usually less reactive and takes a more long-term view of the economy. Governments often use fiscal policy to achieve specific economic goals, such as reducing unemployment or promoting economic growth.

Overall, while both monetary and fiscal policies can have an impact on the overall economy, they are typically used in different ways and serve different purposes. Understanding these differences is essential for anyone who wants to understand how governments influence the economy.

Modern Monetary Theories

Modern monetary theory, or MMT for short, is a body of economic thinking that focuses on money’s role in our economy. At its core, MMT suggests that specific government budget policies and fiscal actions can be taken to ensure strong economic growth and full employment.

One fundamental concept of MMT is the belief that a sovereign nation’s currency operates under different rules than other forms of money. At the same time, individuals and private companies are constrained by financial limits when they borrow money. Countries like the United States do not face similar constraints when doing so through their central bank – meaning they can always print more money to cover their debts if needed. This difference in how sovereign currencies work compared to others has led many economists to view modern monetary theories as a reinvention of existing macroeconomic theories.

However, while some economists may be wary of modern monetary theories, it has gained significant traction in the political and financial realms over the past decade. Many prominent politicians, including former Democratic presidential candidate Bernie Sanders, have voiced their support for at least some aspects of this theory. Moreover, even central banks like the Federal Reserve Bank and European Central Bank (ECB) have begun to take notice of their influence, leading them to adapt their policies accordingly.

Whether you think that modern monetary theories are helpful or harmful to our economy remains a debate among economists and policymakers alike. However, regardless, the principles behind this theory will determine the future of our economy and financial system.

Who Controls Monetary Policy?

Who controls monetary policy varies from country to country. Central banks in most developed economies, such as those in North America and Europe, are typically responsible for making monetary policy decisions. These institutions are given a great deal of independence from political interference and control regarding their monetary policy decisions. They (Independent Central Bank) are also often granted special legal privileges that allow them more power than other public institutions in influencing economic outcomes.

However, the central bank is more closely linked to the political process in some countries, such as China, Pakistan, and India. This can result in the monetary policy being shaped by the priorities of democratically elected officials, with less regard for economic outcomes. In these cases, it can be difficult for central banks to exercise their independence and make decisions that are in the economy’s best interest as a whole.

As a result, there is often debate about who should control monetary policy: politicians or independent experts. Some argue that central bankers have a better understanding of how changes to monetary policy will affect different segments of the economy and, therefore, should be given greater autonomy over their decisions. Others believe that politicians need to consider public opinion when making decisions about monetary policy and that they should be given as much input as possible when making economic decisions.

FAQs:

What is the role of a central bank?

Central banks manage a country’s money supply, control interest rates, regulate banks, and ensure economic stability. They play a key role during financial crises by providing liquidity to banks and stabilizing financial markets.

Why is monetary policy important?

Monetary policy is crucial for controlling inflation, managing interest rates, and maintaining economic stability. By influencing borrowing costs, central banks can encourage or restrict spending and investment in the economy.

What tools do central banks use for monetary policy?

Central banks use tools like interest rate adjustments, open market operations, and reserve requirements to control the money supply and guide economic growth.

What’s the difference between expansionary and contractionary monetary policy?

Expansionary monetary policy aims to boost economic growth by lowering interest rates and increasing the money supply. Contractionary policy, on the other hand, is used to reduce inflation by raising interest rates and decreasing the money supply.

How does inflation targeting work?

Inflation targeting is when a central bank sets a specific inflation rate as a goal, typically around 2%. The central bank then adjusts its policies to keep inflation within that range, ensuring price stability.

Thanks for reading! Share this with friends and spread the knowledge if you found it helpful.

Happy learning with MASEconomics