Welcome to MASEconomics! Today, we’re diving into inflation, explaining what it is and why it matters. Whether you’re a student or just curious, this post is for you. Let’s get started!

What is Inflation?

Imagine waking up one morning to find that the groceries you bought last month cost 10% more today. This isn’t a one-time fluke—it’s inflation, the hidden force that erodes your purchasing power over time. Inflation is a sustained increase in the general price level of goods and services in an economy. In simpler terms, it means that prices are rising, and each dollar buys fewer goods and services.

Understanding inflation is crucial because it affects our day-to-day financial decisions, from budgeting to investing. It shapes the policies set by governments and central banks and has real impacts on the purchasing power of households, the cost of living, and business operations. By grasping the ins and outs of inflation, we can make more informed financial choices and better navigate an increasingly volatile economic landscape.

Types of Inflation Explained

Economists have identified several types of inflation. Let’s break them down to understand how different forces contribute to rising prices.

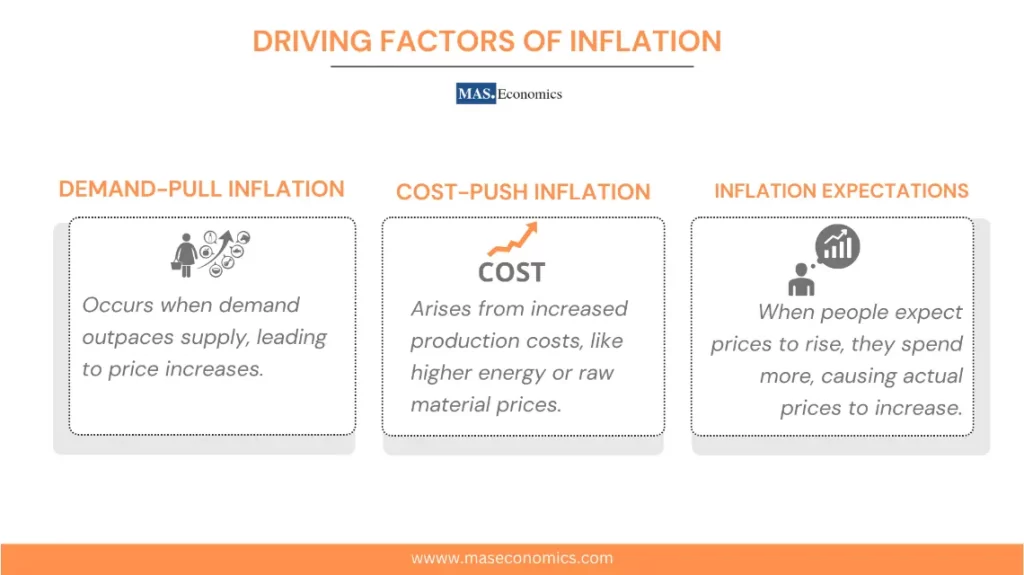

Demand-Pull Inflation

Demand-pull inflation occurs when the demand for goods and services outstrips supply. This often happens when consumers have more disposable income, creating heightened demand for products. As a result, businesses raise prices to keep up with this demand. A classic example of demand-pull inflation occurred during the post-World War II economic boom in the United States, where consumer demand surged and prices followed suit.

Cost-Push Inflation

Cost-push inflation happens when the cost of production rises—due to factors like increased raw materials or labor costs—and businesses pass these costs onto consumers through higher prices. The 1973 oil crisis is an iconic example, where a sharp increase in oil prices raised production costs globally, leading to widespread inflation.

Built-In Inflation

Built-in inflation refers to the expectation of continued inflation, which leads to workers demanding higher wages to maintain their purchasing power. As wages increase, businesses raise prices to cover their increased labor costs, perpetuating the inflationary cycle. This type of inflation is often seen in economies with strong labor unions and wage indexation.

Structural Inflation

Structural inflation occurs when there are persistent supply-side issues in an economy, such as inadequate infrastructure, inefficient production processes, or market rigidities. These factors can lead to higher costs and prices, even in the absence of increased demand. Developing countries often experience structural inflation due to their evolving economic systems.

How is Inflation Measured?

Economists rely on various tools to measure inflation and track changes in the price level over time. Let’s take a look at three commonly used measures:

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is the most common measure of inflation. It tracks the average change in prices paid by urban consumers for a representative basket of goods and services, including food, housing, transportation, and healthcare. The CPI is calculated by taking the price of the basket in a given year and dividing it by the price of the same basket in a base year, then multiplying by 100.

CPI = (Price of basket in given year / Price of basket in base year) × 100

While the CPI is a useful tool for measuring inflation, it has some limitations. For instance, it does not account for changes in consumer behavior, such as substituting cheaper goods for more expensive ones. Additionally, the CPI may not accurately reflect the experiences of all households, as consumption patterns vary across different income levels and regions.

GDP Deflator

The GDP deflator is another measure of inflation that tracks the average change in prices of all goods and services produced in an economy. It is calculated by dividing the nominal GDP (GDP at current prices) by the real GDP (GDP at constant prices) and multiplying by 100.

GDP Deflator = (Nominal GDP / Real GDP) × 100

The GDP deflator is considered a more comprehensive measure of inflation than the CPI, as it includes prices of all goods and services, not just those consumed by households. However, it is released less frequently than the CPI and is subject to revisions as more data becomes available.

Personal Consumption Expenditures (PCE)

The Personal Consumption Expenditures (PCE) price index is a measure of inflation that tracks the average change in prices of goods and services consumed by households. It is similar to the CPI but has a broader scope, including goods and services purchased on behalf of consumers, such as employer-provided health insurance.

The PCE is the preferred inflation measure of the Federal Reserve, as it better captures changes in consumer behavior and is less affected by substitution bias than the CPI. It is an important indicator of overall economic health and is closely watched by policymakers and investors.

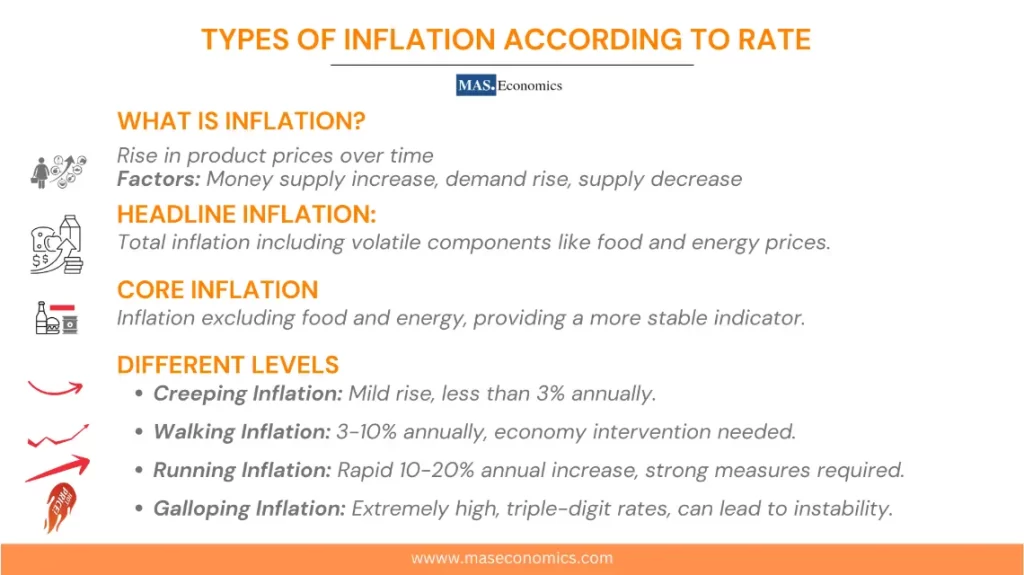

Inflation Rates

Now that we know how inflation is measured, let’s categorize it based on the rate at which prices are rising.

Creeping Inflation

Creeping inflation, also known as mild inflation, occurs when prices rise gradually, typically at an annual rate of less than 3%. This type of inflation is generally considered acceptable and even desirable, as it encourages consumption and investment. Most developed countries aim to maintain a low and stable rate of creeping inflation.

Walking Inflation

Walking inflation refers to an annual inflation rate between 3% and 10%. At this level, inflation becomes more noticeable and can start to have negative effects on the economy. Governments and central banks may take steps to control walking inflation, such as raising interest rates or reducing the money supply.

Running Inflation

Running inflation occurs when the annual inflation rate is between 10% and 20%. This level of inflation can have severe consequences for the economy, eroding the purchasing power of money and leading to economic instability. Countries experiencing running inflation often require significant monetary and fiscal interventions to bring prices under control.

Galloping Inflation

Galloping inflation, also known as high inflation, occurs when the annual inflation rate exceeds 20%. At this level, prices are rising so rapidly that money loses its value quickly, and economic activity becomes severely disrupted. Galloping inflation can lead to social and political unrest, as people struggle to cope with the rapidly increasing cost of living.

Effects of Inflation: Pros and Cons

While inflation is often viewed negatively, it does have some advantages.

Advantages

While inflation is generally seen as a problem, it can have some advantages in certain situations. For example:

Moderate inflation can stimulate economic growth by encouraging consumption and investment.

Inflation can help reduce the real value of debt, making it easier for borrowers to repay their loans.

In the short run, inflation can boost employment by allowing businesses to increase prices without immediately raising wages.

Disadvantages

However, the disadvantages of inflation often outweigh the advantages, especially when it becomes excessive. Some of the main drawbacks include:

Inflation erodes the purchasing power of money, making it harder for people to afford goods and services.

High inflation can lead to economic instability and uncertainty, discouraging investment and slowing economic growth.

Inflation can exacerbate income and wealth inequality, as it disproportionately affects those on fixed incomes or with lower wages.

Costs of Inflation: Expected vs. Unexpected

Expected Inflation

Expected inflation refers to the anticipation of future price increases, which can lead to several costs for the economy:

- Menu costs: Businesses must frequently update their prices, incurring costs for printing new menus, catalogs, and price tags.

- Shoe leather costs: Consumers spend more time and effort searching for the best prices, leading to increased transaction costs.

- Distortion of price signals: Inflation can make it harder for businesses and consumers to distinguish between relative price changes and general price increases, leading to inefficient decision-making.

- Tax distortions: Inflation can push taxpayers into higher tax brackets, even if their real income has not increased, leading to higher tax burdens.

Unexpected Inflation

Unexpected inflation occurs when the actual inflation rate differs from what was anticipated. This can lead to several costs, such as:

- Redistribution of wealth: Unexpected inflation can transfer wealth from creditors to debtors, as the real value of debt decreases.

- Increased uncertainty: Unanticipated inflation can make it harder for businesses and individuals to plan for the future, leading to reduced investment and economic growth.

- Misallocation of resources: Unexpected inflation can cause businesses to make inefficient investment and production decisions based on incorrect price signals.

Hyperinflation

Hyperinflation is an extreme case of inflation, where prices increase at an annual rate of 50% or more. It typically occurs when there is a significant increase in the money supply without a corresponding increase in economic output. Hyperinflation can have devastating effects on an economy, leading to a complete breakdown of the monetary system and social unrest.

Case Study: Zimbabwe

One of the most notable examples of hyperinflation in recent history occurred in Zimbabwe between 2007 and 2009. During this period, the country experienced an annual inflation rate of 79.6 billion percent, with prices doubling every 24.7 hours. The hyperinflation was caused by a combination of factors, including government mismanagement, corruption, and the collapse of the agricultural sector following a controversial land reform program.

To cope with the hyperinflation, the Zimbabwean government introduced several measures, such as printing larger denomination banknotes and eventually abandoning the Zimbabwean dollar in favor of foreign currencies. The experience of hyperinflation in Zimbabwe highlights the importance of responsible monetary and fiscal policies in maintaining economic stability.

Stagflation

Stagflation is a rare economic phenomenon characterized by high inflation, slow economic growth, and high unemployment. It presents a unique challenge for policymakers, as traditional measures to combat inflation, such as raising interest rates, can further slow economic growth and increase unemployment.

Stagflation can be caused by various factors, including:

Supply shocks: A sudden increase in the cost of key inputs, such as oil, can lead to higher prices and reduced economic output.

Structural issues: Inefficiencies in the labor market or problems with productivity can contribute to stagflation.

Policy mistakes: Inappropriate monetary or fiscal policies can exacerbate inflationary pressures while failing to stimulate economic growth.

The most notable example of stagflation occurred in the United States during the 1970s, when the economy experienced high inflation, slow growth, and rising unemployment. The situation was worsened by the 1973 oil embargo, which led to a sharp increase in energy prices. To combat stagflation, policymakers must carefully balance measures to control inflation with efforts to stimulate economic growth and reduce unemployment.

Inflation vs. Disinflation vs. Deflation

While inflation refers to a sustained increase in the general price level, disinflation and deflation describe different economic phenomena.

Disinflation

Disinflation occurs when the rate of inflation slows down but remains positive. For example, if the annual inflation rate decreases from 4% to 2%, the economy is experiencing disinflation. Disinflation can be caused by factors such as reduced aggregate demand, increased productivity, or tighter monetary policy. While disinflation is generally seen as a positive development, as it can lead to more stable prices and increased purchasing power, it can also signal a slowdown in economic growth.

Deflation

Deflation, on the other hand, refers to a sustained decrease in the general price level. This means that the average price of goods and services in an economy is falling over time. Deflation can be caused by factors such as reduced money supply, increased productivity, or a decrease in aggregate demand. While falling prices may seem beneficial for consumers in the short run, deflation can have severe negative effects on the economy, including:

Increased real debt burden: As prices fall, the real value of debt increases, making it harder for borrowers to repay their loans.

Delayed consumption: Consumers may postpone purchases in anticipation of lower prices in the future, leading to reduced aggregate demand and economic growth.

Reduced profits and investment: Falling prices can squeeze business profits, leading to reduced investment and employment.

Policymakers generally aim to avoid deflation and maintain a low and stable rate of inflation to promote economic stability and growth.

Conclusion

Inflation is a complex and multifaceted economic phenomenon that impacts every aspect of our lives. By understanding its causes, measurement, and effects, we can make more informed decisions about saving, investing, and planning for the future.

Key points to remember include:

Inflation can be caused by factors such as increased demand, rising production costs, and structural issues in the economy.

Inflation is typically measured using indices such as the Consumer Price Index (CPI), GDP deflator, and Personal Consumption Expenditures (PCE) price index.

While moderate inflation can have some advantages, such as stimulating economic growth, high inflation can lead to economic instability and reduced purchasing power.

Hyperinflation and stagflation are extreme cases of inflation that can have severe negative consequences for an economy.

Ultimately, maintaining a low and stable rate of inflation is crucial for promoting economic growth, stability, and individual financial well-being. By staying informed about inflation and its related concepts, readers can make better decisions about saving, investing, and planning for the future.

FAQs:

What is inflation?

Inflation is the sustained increase in the general price level of goods and services in an economy, reducing the purchasing power of money.

Why does inflation occur?

Inflation can occur due to increased demand for goods and services (demand-pull), rising production costs (cost-push), wage increases (built-in inflation), or structural issues in the economy.

How is inflation measured?

Inflation is measured using indices like the Consumer Price Index (CPI), GDP deflator, and Personal Consumption Expenditures (PCE) price index, which track changes in prices over time.

What is demand-pull inflation?

Demand-pull inflation happens when consumer demand for goods and services exceeds supply, causing prices to rise.

What is cost-push inflation?

Cost-push inflation occurs when the costs of production rise (e.g., higher raw materials or wages), leading businesses to increase prices to maintain profitability.

What is built-in inflation?

Built-in inflation refers to the expectation of rising prices, prompting workers to demand higher wages, which then leads businesses to raise prices further, creating a wage-price spiral.

What are the effects of inflation?

Inflation erodes the purchasing power of money, impacts savings, can lead to higher interest rates, and creates uncertainty for businesses and consumers.

Is inflation always bad?

No, moderate inflation can stimulate economic growth by encouraging spending and investment, but high inflation can disrupt economic stability.

What is the difference between inflation, deflation, and disinflation?

- Inflation is a general increase in prices.

- Deflation is a decrease in the general price level.

- Disinflation is a reduction in the rate of inflation, meaning prices are still rising but at a slower pace.

What is hyperinflation?

Hyperinflation is an extreme form of inflation where prices increase rapidly, often exceeding 50% per month, leading to a collapse in the value of money.

How does inflation affect savings?

Inflation decreases the real value of savings, meaning that money saved today will buy less in the future if prices rise.

What is the Consumer Price Index (CPI)?

The CPI measures the average change in prices of a basket of goods and services commonly purchased by households, serving as a key indicator of inflation.

What causes stagflation?

Stagflation is caused by a combination of high inflation, slow economic growth, and high unemployment, often due to supply shocks or poor policy decisions.

Can inflation reduce debt burdens?

Yes, inflation can reduce the real value of debt, making it easier for borrowers to repay loans with money that is worth less over time.

What is the difference between CPI and the GDP deflator?

CPI measures changes in consumer prices, while the GDP deflator measures changes in prices of all goods and services produced in an economy.

How do central banks control inflation?

Central banks control inflation by adjusting interest rates, using open market operations, and influencing money supply to stabilize prices.

What is the impact of unexpected inflation?

Unexpected inflation can redistribute wealth from lenders to borrowers and create uncertainty, leading to reduced investment and slower economic growth.

What are the costs of inflation?

Costs include menu costs (changing prices frequently), shoe leather costs (time spent managing cash), distorted price signals, and increased uncertainty in economic planning.

Why is low and stable inflation desirable?

Low and stable inflation promotes economic stability, encourages spending and investment, and helps central banks maintain control over the economy.

How does inflation affect investments?

Inflation can reduce the real returns on investments, especially fixed-income assets like bonds, making it important for investors to seek returns that outpace inflation.

Thanks for reading! If you found this insightful, share the knowledge with friends and spread it on social media!

Happy learning with MASEconomics